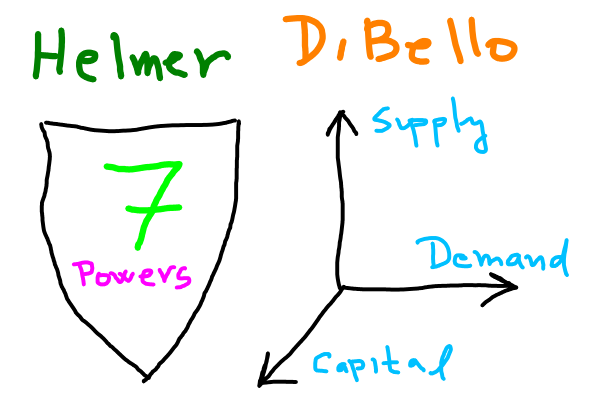

In business, most of the excess profits come from delivering more from less compared to the next best alternative including competition. The Helmer’s 7 Powers book lists 7 barriers that protect margins of businesses long term and how to attain them. DiBello’s research suggests that great business people understand interaction between following three aspects (dimensions) of a business: demand, supply, capital. The text below may provide additional insights into both through partial modification, followed by combination of the ideas above. For example, Helmer’s book does not list capital side of the described moats and network effects between employees and between investors, while below hints that they may exist. Additionally, since moats are so crucial to the business value, we should have tools to understand and talk about them. DiBello’s dimensions can give us axis where to pain effects of our moats.

I may have slightly modified some concepts to offer an interesting view. For example for Cedric all the concepts fall into “Demand” dimension of DiBello’s model. This is my initial version of the post on this topic.

DiBello Mental Model Dimensions

DiBello’s research suggests that there is a triad of crucial aspects of a business that great business people understand. Here I state the DiBello’s dimensions of mental model of business, adding units, agents, and related terms. For details, I recommend reading Mental Model of Business or the original paper.

The three core areas are:

Supply, leadership, operations

- factors: management, incentives, systems, design blueprints, manufacturing, production, product development

- agents: employees, managers, executives, human resources

- comment: This dimension deals with company-internal matters. Here the company transforms the inputs into outputs.

Demand, strategy, market

- factors: deal, sale, law, marketing, purchase, brand asset, positioning, exchange, trade, inputs, outputs …

- agents: customers, suppliers, competition, government, prospect

- comment: This dimension represents exchange with the outside. Here the company inputs and outputs are connected.

Capital, finance, economic climate

- factors: financial metrics and performance, cost of capital and goods sold, return on ads spend, fixed assets, receivables, R&D, cashflow, debt, equity receivables, cost of capital, …

- agents: investors, bondholders, CFO

- comment: I see this dimension as a mainly quantitative or performance measuring, because various inputs and outputs are already part of the demand. Capital is different (more liquidity, services), but not sure if enough different.

Some topics or agents operate across the dimensions. Do we include CFO in to the capital dimension or the supply? Nick Huber of Sweaty Startup seems to be thinking along the two of the main dimensions describes “Every company has a customer or a employee problem”.

Organisation and often split into departments that specialize in some of the dimensions. The patter structure is then nested or fractal, as departments themselves then again deal with at least some aspect of each dimension.

Every company seems have to involve some transformation between two types of goods (input, output or bi-directional) and exchange of them in the market. Finance plays a role of monitoring of quantitative attributes of the exchanges, the Demand is the exchange itself, the Supply is involved with the processes and algorithms used to achieve the value transformation. For example, annuity is transformation of a lump sum into a contract of time-distributed payments (capital over time). It may be useful to separate inputs and outputs into two dimensions, but in general they are part of the Demand.

Suppliers are distinguished from customers by the direction of flow of money. In case of Google users and webpage owners are suppliers and advertisers are customers. If the flow is bidirectional suppliers may be indistinguishable from customers, which seems rare.

The type of investors that a business attracts is heavily influenced by the characteristics of the business. There are kickstarter project investors, small initial investors (e.g. Amazon early on got lots of small investor calls), real-estate investors. Investors can be sizable group of people with differing levels of influence and relationship with the business.

7 Powers From Perspective of DiBello’s

Helmer’s book defines Power as “the set of conditions creating the potential for persistent differential returns”. It is about building defensive moat, or a barrier to protect margins from competitive arbitrage. For a summary I recommend reading 7 Powers summary. Below I offer a view of the powers through the lens of DiBello’s model. I split them according to company stage to which they become accessible.

Startup Stage Powers

Counter-positioning - Where big players cannot follow?

- benefited dimensions: supply, demand, capital

- barrier: big players optimized in local maximum with lots of trust cannot follow

- examples: specialized production, niche market, business model

Cornered-Resource - What can you own exclusively almost all of?

- benefited dimensions: supply, demand, capital

- barrier: external force of contracts, laws

- examples: exclusive contract, patent, regulation, property, employee, exclusive funding

Scaleup Stage Powers

Scale - How to pay fixed-cost or network the agents?

- Scale Economies (Supply side-scale) - production fixed-costs or networking employees

- benefited dimensions: supply

- barrier: market share

- examples: shooting movies to distribute across many subscribers (Netflix)

- Demand-side Scale Economy (Network) - Demand fixed-costs or networking customers

- benefited dimensions: demand

- barrier: market share

- examples: social networks (Facebook), marketing fixed-costs (Red Bull), recommender systems, Google ranking

- “Capital Scale Economies” - Capital fixed-costs or networking investors

- benefited dimensions: capital

- barrier: market share

- examples: IPO has high fixed-costs of regulatory reporting

- Investor network effects perhaps exist as reflexivity (the more people want the Mona Lisa the higher it is priced)

- Web3 brings in new possibilities, so perhaps we see more in future?

Switching costs - Why customers, investors, employees cannot switch to competition without a friction?

- benefited dimensions: supply, demand, capital

- barrier: competitor has to pay switching costs

- examples: deep integration with systems, data and configuration stored in the systems, habits, Non-compete clause

Corp-up Stage Powers

Hysteresis: (optimization, trust, stability):

Process Power - What creates non-replicable and stable organizational capability?

- benefited dimensions: supply

- lower costs per unit of supply due to optimization and trust of employees

- barrier: time in production

Branding - What accrues trust and nostalgia with users and markets optimally?

- benefited dimension: demand

- lower costs per unit of demand due to optimization and trust of customers

- barrier: time in market

“Lindy Effect” - What accrues trust and optimizes capital operations?

- benefited dimension: capital

- low cost of capital thanks to optimization and trust of investors

- example: Blue chip stocks

Next Steps

Here is how you can use the above text:

-

Categorize roles and departments in your organization into the supply, demand, and capital dimensions. This will help you identify the key areas and individuals that contribute to building and maintaining your competitive edge.

-

Assess the current moats available in each dimension and identify potential opportunities for strengthening or acquiring new moats. For example, consider investing in process optimization or improving brand equity to create barriers against competition.

Acknowledgments

I only found about topics above thanks to Cedric’s blog posts over at Common Place Blog. I am personally a paying subscriber of the Commonplace blog to have access to member’s only posts and the community. Also thanks to Cedric explaining that I originally modified the definition of the DiBello’s model and a lots of other good comments. I rewrote the post a few times into current form.